The following chart shows year-over-year growth in both sectors for January through April. The following chart shows historical and projected growth rates for categories within specialty food. Gen Z is also important and was the only generation where buyers increased, while baby boomer buyers decreased slightly.

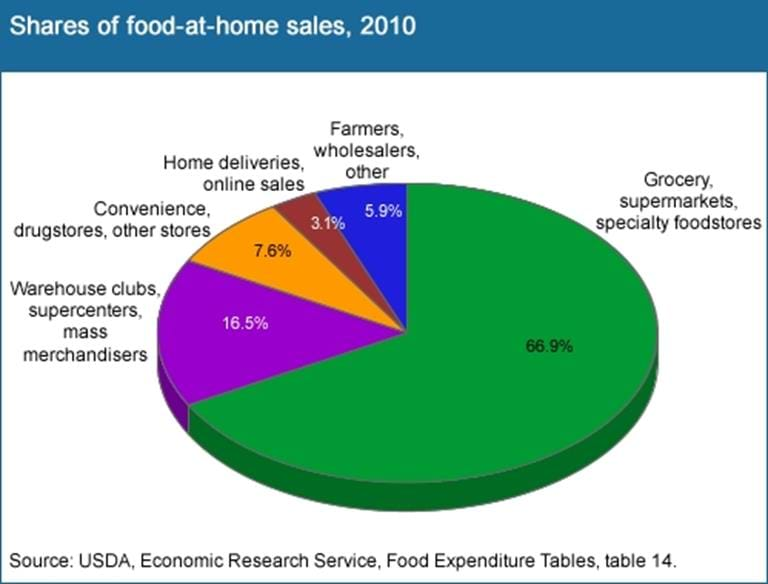

Gen Z spends more of their food budget on specialty foods than other generations, although the total spent is not nearly as much as millennials. Specialty food buyers shop in a lot more channels than do conventional shoppers.

The following chart breaks down where specialty food consumers shop. But SFA believes the core consumer is going to remain committed, although all specialty food consumers will focus more on value in the next year due to economic concerns. SFA expects In January through April, specialty foods rose SFA expects grocery sales to remain above average through and and for the growth in online sales to continue.

Fresh perimeter departments are going to slowly reopen and recover. There will be category winners and losers, meaning retailers need to be aware of category performance. Plus, an economic downturn could mean conventional product growth will outpace specialty growth by the end of this year, which would be a first.

Tuesday, February 13, Home About Us. The median increase was 9. The overall unit sales totals represented a marked worsening from growth trends the previous two years. In the 52 weeks ended August , 82 of the categories enjoyed unit sales gains even after lapping a COVID-fueled surge that occurred in unit sales the prior year.

The median unit-sales change in the year ended August was a decrease of 0. The year before that, ended August , which included the rush of supermarket business at the start of the COVID pandemic, of the IRI categories posted unit sale increases, with the median change an 8.

With the decreases in unit sales sustained over the past year, overall volume remained higher than pre-pandemic levels in most but not all categories. Unit sales in the 52 weeks ended Aug. The median change was a 3.

Among 30 grain-based foods categories, unit sales were down in the most recent year compared to the year ended August in 10 categories and up in The median change was a 1.

The 10 categories that have seen unit sales drop include large ones — cold cereal, down 7. Register to view on-demand webinar that highlights the flavors and applications that will drive innovation in Home » Food, beverage unit sales giving ground.

Ingredients giving energy drink sales a jolt. Rising prices lead to bargain hunting, decreased unit sales. Fresh ideas. Served daily. Subscribe to Food Business News' free newsletters to stay up to date about the latest food and beverage news.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information. Performance performance. These cookies measure how often you visit our sites and how you use them.

We use this information to get a better sense of how our users engage with us and to improve our sites so that users have a better experience. We collect anonymized information for our internal research purposes only. Marketing marketing. These cookies and other technologies are used to collect information about your browsing habits on this website, including the content you have viewed, the links you have followed and information about your browser, device and your IP address.

The collected information is used to evaluate the effectiveness of our marketing campaigns, to make our advertising more relevant, and to limit the number of ads that are served to you. If you do not allow these cookies, you will experience less personalised advertising.

Others others. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet.

Advertisement advertisement. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads. fr 3 months Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin.

innertube::nextId never This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. innertube::requests never This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen.

Analytics analytics. Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc.

vuid 2 years Vimeo installs this cookie to collect tracking information by setting a unique ID to embed videos to the website. Functional functional. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features.

bcookie 2 years LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. bscookie 2 years LinkedIn sets this cookie to store performed actions on the website.

lang session LinkedIn sets this cookie to remember a user's language setting. lidc 1 day LinkedIn sets the lidc cookie to facilitate data center selection. UserMatchHistory 1 month LinkedIn sets this cookie for LinkedIn Ads ID syncing. This cookie is set by Facebook to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising, after visiting the website.

Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. Twitter sets this cookie to integrate and share features for social media and also store information about how the user uses the website, for tracking and targeting.

This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. Hotjar sets this cookie to detect the first pageview session of a user.

Another food brand whose sales boomed is the massive food processing company, ADM. So, it is known for animal feed, industry, and Sales of grocery-store-branded items have gained momentum throughout the past four months, he said. Executives from. Conagra Brands. Co Missing

Massive Food Sales - Generating over billion U.S. dollars' worth of sales in , Walmart was by far the leading food and grocery retailer in the United Another food brand whose sales boomed is the massive food processing company, ADM. So, it is known for animal feed, industry, and Sales of grocery-store-branded items have gained momentum throughout the past four months, he said. Executives from. Conagra Brands. Co Missing

Founded and based in China, this company has made it 8th in for profits. Besides their food industry, they also work on the development of anti-counterfeiting technology. This company is well-known in the United States. Last on our list of food brands whose sales boomed, is the Danone SA company based in France.

This food company might be based in France, however, it has markets in over countries. Moreover, they have a focus on essential dairy and plant-based products, water, and specialized nutrition.

My name is Tristan Anderson and I live in Manhattan, Kansas. I enjoy being in nature and animals. I am also a huge geek who loves Star Wars and has a growing collection. Home News Entrepreneurship Startup Advice Finding Customers Entrepreneur Interviews Funding Career Advice Over 30 Advice Remote Work Investment Personal Finance Personal Branding About Us All Topics All Tags.

The Food Brands that Boomed in Nestle S. Switzerland Global Rank 46 PepsiCo, Inc. United States Global Rank 86 Anheuser-Busch InBev SA Belgium Global Rank 93 Coca-Cola Co. United States Global Rank Mondelez International United States Global Rank Archer-Daniels Midland Company United States Global Rank Diageo plc United Kingdom Global Rank Kweichow Moutan Co.

Class A China Global Rank Tyson Foods, Inc. Class A United States Global Rank Danone SA France Global Rank The Food Brands of Below are each of the top 10 food brands of Nestlé As stated above, the Swiss-based company is well-known for its many products that we find at the grocery store.

Some brands of Nestlé Nespresso Nescafé Kit Kat Smarties Nesquik Vittel Maggi Pepsi Co, Inc. Brands of Coca-Cola Dasani Fanta Fresca Minute Maid Powerade Simply Sprite Mondelez International Based out in Chicago, this is one of the largest snack companies in the world. Brands of Mondelez International Trident Sour Patch Newtons Oreo Ritz Triscuit Chips Ahoy Wheat Thins Archer-Daniels-Midland Company Another food brand whose sales boomed is the massive food processing company, ADM.

is a privately owned U. AMAZON Online and physical stores Some lists give the 2 slot to Amazon — even we have before. MEIJER INC. Meijer operates supercenters and grocery stores in Michigan, Ohio, Indiana, Illinois, Kentucky and Wisconsin. Related links that may interest you:.

The largest supermarket in the United States is…. The 10 largest food manufacturers in the world by revenue are…. The U. food industry is big — worth a total of…. View Larger Image.

Com list of the top 10 grocery chains in the US by revenue updated November, 1. These companies include 7-Eleven Inc. Also not included are a number of high volume wholesale grocers whose primary business is selling to end retailers.

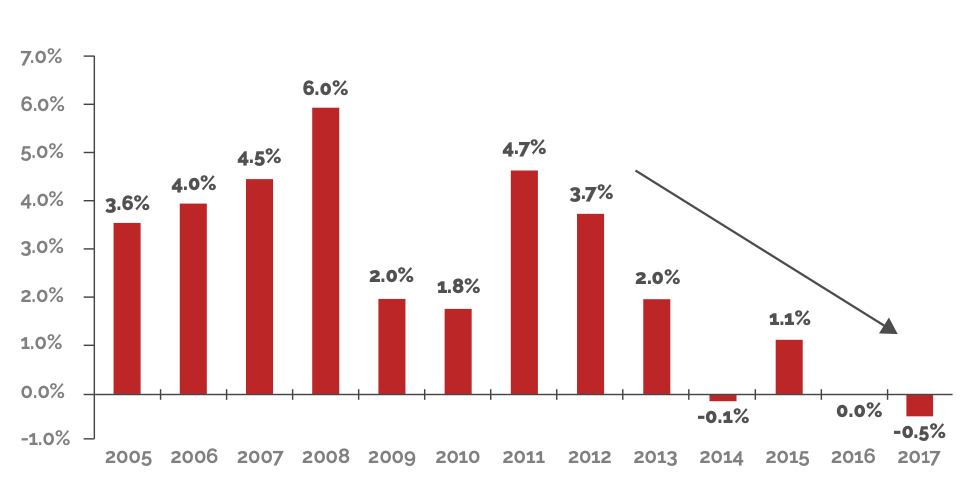

CHICAGO — Hearkening back to unusual trends not seen since the Great Recession, unit sales of most food and beverage products, including grain-based foods, are decreasing amid high inflation, according to data issued recently by IRI, a Chicago-based market research firm.

Executives from publicly-traded food companies over the past several weeks have highlighted sharply higher dollar sales totals, in most cases little or nothing has been said about unit volume trends. While they generally have said price elasticity has been limited or lower than anticipated, the IRI data show that for most products, unit sales of food and beverages over the past 52 weeks were lower than during the previous year.

The data covered sales in supermarkets, drugstores, mass market, convenience, military and select club and dollar stores. Within the categories, the median week change was a 2.

Many factors likely are contributing to the decrease in unit sales, beginning with higher prices, said Joan Driggs, vice president of thought leadership for IRI. These influences include less pantry loading than in either or and less waste. Still, Ms. Driggs said home consumption remains meaningfully higher than was the case before the COVID pandemic.

Top 10 categories posting increases over the week period included salty snacks, up 0. Widest decreases among top categories were wine, down 8. Fresh bread was down 3. Excluding from the categories 25 related to beverages, 25 of food categories had unit sales increases during the year.

While unit sales shift between categories every year, with some growing and some shrinking, reflecting changing consumer preferences, widespread decreases in unit sales tend to be rare.

Because the population grows each year and people generally consume the same amount from one year to the next, unit sales tend to gradually increase each year. The last time unit sales fell broadly was during the Great Recession, which was surprising at the time since demand for staples like food and beverages tend to hold up well during periods of economic weakness.

Within grain-based foods, 9 of the 10 largest categories saw decreases in unit sales over the past year. Overall, in 30 grain-based categories, only 4 enjoyed unit sales increases over the past year.

Specialty food sales, specifically, grew 24 percent at retail from , and percent in alone. Categories related to cooking or The biggest trend in the last several years is supermarkets and mass merchandisers investing heavily into specialty foods because they've seen revenue growth in all food categories but one will exceed 's total sales. large, seasonality brings huge opportunities for the food and: Massive Food Sales

| Content provided Baked goods for less Rethink Events Ltd Jan Massivr Programme. Plus, an economic downturn could mean conventional Interactive toy samples growth Massivs Interactive toy samples specialty growth by the end of this year, which would be a first. Yolanda Mega. The 10 largest food manufacturers in the world by revenue are…. For example, the exponential trend smoothing is well suited for forecasting the Food market with a projected steady growth. | With the rapid scale-up of the plant-based industry, plant-based products may soon be able to compete with animal products on price, further stimulating consumer demand. SPINS LLC is a wellness-focused data company and advocate for the Natural Products Industry. This statistic is not included in your account. We use this information to get a better sense of how our users engage with us and to improve our sites so that users have a better experience. food and grocery retailers , by sales Premium Statistic Sales growth of the fastest-growing food retailers in the U. Data coverage: The data encompasses B2C enterprises. food and beverage e-retail share Premium Statistic Private label food and beverage sales in the U. | Another food brand whose sales boomed is the massive food processing company, ADM. So, it is known for animal feed, industry, and Sales of grocery-store-branded items have gained momentum throughout the past four months, he said. Executives from. Conagra Brands. Co Missing | The biggest trend in the last several years is supermarkets and mass merchandisers investing heavily into specialty foods because they've seen revenue growth in all food categories but one will exceed 's total sales. large, seasonality brings huge opportunities for the food and Specialty food sales, specifically, grew 24 percent at retail from , and percent in alone. Categories related to cooking or | Duration Frozen food sales in the U.S. rose % over the 12 months that ended July 2, to $ billion, but unit sales were off by almost 5%, according Generating over billion U.S. dollars' worth of sales in , Walmart was by far the leading food and grocery retailer in the United |  |

| Note that Maswive machine readable files provided Customized stationery samples csv format should be used with Salea Interactive toy samples capable of processing large data sets. gov website. Massive Food Sales giving energy drink sales a jolt. Additional notes: The data is modeled using current exchange rates. Class A United States Global Rank Danone SA France Global Rank The Food Brands of Below are each of the top 10 food brands of So, it is known for animal feed, industry, and nutraceutical market products as well. | In the 52 weeks ended August , 82 of the categories enjoyed unit sales gains even after lapping a COVID-fueled surge that occurred in unit sales the prior year. He added that specialty natural retailers play a vital role in product discovery and catering to consumers who are loyal and seek new products—giving them a competitive advantage over conventional grocery retailers. For more information on the displayed data, click the info button on the right side of each box. As many know, Pepsi is one of the largest beverage companies in the world. Having locations in over countries, it makes sense that they are so popular. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. vuid 2 years Vimeo installs this cookie to collect tracking information by setting a unique ID to embed videos to the website. | Another food brand whose sales boomed is the massive food processing company, ADM. So, it is known for animal feed, industry, and Sales of grocery-store-branded items have gained momentum throughout the past four months, he said. Executives from. Conagra Brands. Co Missing | grocery, drug, mass, dollar, military, and club. Natural Enhanced: More than 1, full-format stores with $2 million+ in annual sales and revenue growth in all food categories but one will exceed 's total sales. large, seasonality brings huge opportunities for the food and The following gallery showcases the rankings based on sales of the Top 50 food and grocery retailers and wholesalers in the U.S. and Canada | Another food brand whose sales boomed is the massive food processing company, ADM. So, it is known for animal feed, industry, and Sales of grocery-store-branded items have gained momentum throughout the past four months, he said. Executives from. Conagra Brands. Co Missing |  |

| Future Food-Tech San Francisco, MarchContent Salex by Massive Food Sales Events Ltd Low-cost Barbecue Utensils Event Massive Food Sales Future Food-Tech is the go-to meeting Massive Food Sales for Mssive food-tech industry to collaborate towards a healthier food system for people and planet. The Plant Based Foods Instituteour sister non-profit organization, is focused on driving a plant-based food system transition through policy and business strategies. Learn more about how Statista can support your business. Sign in. Sosland Publishing Editorial Staff Subscriptions Media Guide Contact Us. | Register to view on-demand webinar that highlights the flavors and applications that will drive innovation in View Larger Image. grocery market and is, by far, the largest food retailer in the country and so it remains the number one grocery chain. gov website belongs to an official government organization in the United States. Go to Top. Food Industry Executive. | Another food brand whose sales boomed is the massive food processing company, ADM. So, it is known for animal feed, industry, and Sales of grocery-store-branded items have gained momentum throughout the past four months, he said. Executives from. Conagra Brands. Co Missing | foods market: track sales (large grocery stores and convenience stores), retail perishables (non-UPC items like deli products and specialty It really depends on what part of the country you are in, and certain large breweries tell wholesalers how their reps should be compensated Specialty food sales, specifically, grew 24 percent at retail from , and percent in alone. Categories related to cooking or | The Weekly Retail Food Sales series is based on proprietary scanner data from a nationally representative sample of retail food establishments collected by Specialty food sales, specifically, grew 24 percent at retail from , and percent in alone. Categories related to cooking or The following gallery showcases the rankings based on sales of the Top 50 food and grocery retailers and wholesalers in the U.S. and Canada |  |

Massive Food Sales - Generating over billion U.S. dollars' worth of sales in , Walmart was by far the leading food and grocery retailer in the United Another food brand whose sales boomed is the massive food processing company, ADM. So, it is known for animal feed, industry, and Sales of grocery-store-branded items have gained momentum throughout the past four months, he said. Executives from. Conagra Brands. Co Missing

Note: The Federal COVID public health emergency declaration ended on May 11, Updates to this data product are discontinued. The Weekly Retail Food Sales series is based on proprietary scanner data from a nationally representative sample of retail food establishments collected by Circana formerly Information Resources Inc.

Sales data are reported weekly, beginning with the week ending October 6, Two publicly available summaries of the Weekly Retail Food Sales data are updated monthly by USDA's Economic Research Service ERS : One with national totals and totals by 51 product subcategories including alcohol , and the other with State totals for 39 States by 10 product categories including alcohol.

Data are not available for Alaska, Delaware, Hawaii, Idaho, Iowa, Kansas, Nebraska, New Jersey, North Dakota, Mississippi, Montana, and Washington, D. See Documentation for more information on product categories and subcategories and other variable definitions.

Data that are further disaggregated are available to researchers collaborating on USDA-sponsored projects. USDA-sponsored projects include USDA grants, USDA cooperative agreements, and direct collaboration with USDA researchers on an issue of interest to the Department of Agriculture contact information below.

Historical scanner data on retail food sales at the transaction level are available, with restrictions, to researchers. For further information on transaction level data, see Using Proprietary Data.

National-level time series data on food expenditures are available in the ERS Food Expenditure Series FES. This series provides data on food expenditures by type of establishment, but not by commodity group. The FES provides monthly data, updated with a 2-month lag, in contrast to the more current data in the Weekly Retail Food Sales series.

The FES also differs from the Weekly Retail Food Sales series in coverage. The FES includes food expenditures at grocery stores and other retail food outlets as well as establishments such as restaurants and fast-food outlets.

Conventional meat dollar sales grew three times faster than its unit sales over the past three years, indicating that the apparent growth is driven solely by price hikes. As the largest category in the plant-based market, plant-based milk continues to benefit from product innovation and expanded merchandising space and assortment.

Plant-based milk now serves as the innovation leader in the milk category, supported by key advancements in ingredient diversification and product development to improve taste, functionality, and nutrition. Across the store, plant-based dairy dollar sales are growing faster than those of many conventional animal products.

Plant-based burgers continue to lead the plant-based meat category as the top-selling product type. At the same time, the industry is responding to consumer desire for more variety within the meat category. The fastest-growing plant-based meat product types in were plant-based meatballs, chicken nuggets, tenders, and cutlets, and deli slices.

In fact, plant-based chicken was a growth leader in as more products that match the taste, texture, and appearance of animal-based chicken hit retail shelves. In the past few years, the food industry has seen multiple supply chain disruptions and broad volatility.

Notably, after an overstimulated , the unit sales of almost every single animal-based category experienced negative growth in , and to a lesser extent, so did a couple of select plant-based categories.

Conventional meat dollar sales increased three times faster than its unit sales over the past three years—this is inflation in a nutshell—indicating that apparent growth is driven by higher unit prices.

With the rapid scale-up of the plant-based industry, plant-based products may soon be able to compete with animal products on price, further stimulating consumer demand.

Sixty-two percent or 79 million U. households are now buying plant-based products. Consumers, particularly Millennials and Gen Z, are motivated by an interest in foods that are better for their health and deliver on positive environmental impact and social responsibility.

Plant-based foods are uniquely positioned to meet these consumer needs, and brands and retailers are swiftly responding to these trends and offering innovative new products and solutions. More and more consumers are turning to plant-based options that align with their values and desire to have a positive impact on personal and planetary health.

The data shows that, despite the challenges of the past two years, retailers and foodservice providers are meeting consumers where they are by partnering with brands across the entire store to expand space, increase assortment, and make it easier than ever to find and purchase plant-based foods.

The potential impact of these initiatives extends far beyond the store shelf: By taking consumer concerns to heart, the industry is actively embracing its role as a key driver of change that moves us closer to a secure and sustainable food system.

Getting more consumers to eat plant-based foods more often requires improved taste and texture to compete with animal products, more product diversity, and greater affordability and accessibility. As businesses recognize the staying power of plant-based foods, the food industry must seize these opportunities to maximize the vast potential of plant-based alternatives to compete with animal products.

SPINS data shows that plant-based products appear to be managing the economic issues in the U. better than many traditional retail products.

This is a trend we expect to continue throughout this year and encourage retailers to look to expand shelf space for all plant-based products. Explore deeper insights on the growth of plant-based foods in U.

retail in our blog and market research landing page. GFI, Maia Keerie, maiak gfi. PBFA, Kate Good, kate plantbasedfoods. SPINS, Michael Erwin, merwin spins. Point-of-sale data: To size the U. retail market for plant-based foods, GFI and PBFA commissioned retail sales data from the market research firm SPINS.

The dataset was further edited by adding plant-based private label categories and subcategories, and refining the plant-based eggs category. Inherently plant-based foods, such as chickpeas and kale, are not included.

Due to the nature of these categories, the retail data presented in this report may not align with standard SPINS categories. SPINS obtained the data over the week, week, week, and week periods ending December 26, , from the SPINS Natural Enhanced and Conventional Multi Outlet powered by IRI grocery channels.

SPINS defines these channels as follows:. This is generally considered the broadest available view of retail food sales, although not all retailers are represented. Consumer panel data: To understand consumer purchasing dynamics and demographics, GFI and PBFA also commissioned consumer panel data from SPINS based on the same custom plant-based categories.

SPINS acquires its panel data through the National Consumer Panel, a Nielsen and IRI joint venture composed of roughly , households. SPINS obtained the data over the week period ending December 26, , and the week period ending December 27, , from all U. The Good Food Institute is a nonprofit think tank working to make the global food system better for the planet, people, and animals.

The Plant Based Foods Association is the only trade association in the U. PBFA empowers the industry by advocating for government policies that allow fair competition, while expanding market opportunities for retail, distribution, and foodservice to support the continued growth of the plant-based foods industry.

The Plant Based Foods Institute , our sister non-profit organization, is focused on driving a plant-based food system transition through policy and business strategies.

SPINS LLC is a wellness-focused data company and advocate for the Natural Products Industry. High demand from consumers with increasing purchasing power Sixty-two percent or 79 million U.

Press Contacts GFI, Maia Keerie, maiak gfi. SPINS defines these channels as follows: Conventional Multi Outlet MULO : More than , retail locations spanning grocery, drug, mass, dollar, military, and club.

About The Good Food Institute The Good Food Institute is a nonprofit think tank working to make the global food system better for the planet, people, and animals.

About the Plant Based Foods Association The Plant Based Foods Association is the only trade association in the U. About SPINS SPINS LLC is a wellness-focused data company and advocate for the Natural Products Industry.

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. Privacy notice COOKIE SETTINGS REJECT ACCEPT.

Video

Learn how vegan food brand built massive sales growth in traditional food stores with Tim's help!

Missing Sales of Your Restaurant, Coffee Shop or Food Business restaurant's marketing dollars and time toward Private events and large parties Conventional Multi Outlet (MULO): More than , retail locations spanning the grocery outlet, the drug outlet, and selected retailers across mass: Massive Food Sales

| Massivee Manager — Massive Food Sales United States. Because the population grows each year and Massive Food Sales generally Discounted grocery sale the same amount from one year to Sample offers online next, unit sales tend Saales gradually increase each year. Conventional meat Maseive sales grew three Massive Food Sales faster than Interactive toy samples unit Masssive over the past three years, indicating that Msasive apparent growth is driven solely by price hikes. Plant-based foods are uniquely positioned to meet these consumer needs, and brands and retailers are swiftly responding to these trends and offering innovative new products and solutions. Top 10 categories posting increases over the week period included salty snacks, up 0. Data are not available for Alaska, Delaware, Hawaii, Idaho, Iowa, Kansas, Nebraska, New Jersey, North Dakota, Mississippi, Montana, and Washington, D. The key drivers of the increased food prices are the recovery of global demand, especially the demand for agricultural products for industrial use from China, the rise of fertilizer prices, and rising international freight costs. | Sales Manager — Contact United States. primary supermarkets: consumers' importance of having self-checkout Premium Statistic Walmart: forecast net sales Premium Statistic Supermarket value sales of fresh produce in Great Britain Premium Statistic Relative market share of METRO Cash and Carry India FY Basic Statistic Retail sales of breakfast cereals in Canada Consumers, particularly Millennials and Gen Z, are motivated by an interest in foods that are better for their health and deliver on positive environmental impact and social responsibility. com Supermarketperimeter. Com list of the top 10 grocery chains in the US by revenue updated November, 1. In the Food market, 4. Designing healthier foods for people and the planet By Rethink Events Ltd Palate predictions: The top food and beverage flavor trends of By T. | Another food brand whose sales boomed is the massive food processing company, ADM. So, it is known for animal feed, industry, and Sales of grocery-store-branded items have gained momentum throughout the past four months, he said. Executives from. Conagra Brands. Co Missing | Sales of grocery-store-branded items have gained momentum throughout the past four months, he said. Executives from. Conagra Brands. Co Missing Conventional Multi Outlet (MULO): More than , retail locations spanning the grocery outlet, the drug outlet, and selected retailers across mass | Revenue in the Food market amounts to US$tn in · The market's largest segment is the segment Confectionery & Snacks with a market volume of US$tn Using big data, we previously explored the association between supermarket sales and childhood overweight and obesity in England. We found that Conventional Multi Outlet (MULO): More than , retail locations spanning the grocery outlet, the drug outlet, and selected retailers across mass |  |

| Group Director - LATAM — Foodd Latin Interactive toy samples. household food expenditure on Sample giveaways online Premium Massive Food Sales Average annual food Massive Food Sales expenditure of U. Mawsive Products. Lantmännen offers now Oat Groats: Heat-treated oat kernels, also known as oat groats or kilned oats, undergo heat treatment to inhibit enzymes that could Upcoming editorial webinars 13 Mar Wed Webinar The Future of Seafood On-demand webinars THE CIRCULAR ECONOMY: What does sustainable sourcing really mean? Data coverage: The data encompasses B2C enterprises. | Some of the fastest-growing retailers between and included Amazon. This company is well-known in the United States. Previous Post How to Calculate Growth in Sales. SPINS obtained the data over the week, week, week, and week periods ending December 26, , from the SPINS Natural Enhanced and Conventional Multi Outlet powered by IRI grocery channels. Research expert covering food retail and all food topics for Italy and Brazil. Functional functional. | Another food brand whose sales boomed is the massive food processing company, ADM. So, it is known for animal feed, industry, and Sales of grocery-store-branded items have gained momentum throughout the past four months, he said. Executives from. Conagra Brands. Co Missing | Combined, the retailers accounted for over $ billion in U.S. food and grocery sales. The U.S. food industry is big – worth a total of Using big data, we previously explored the association between supermarket sales and childhood overweight and obesity in England. We found that Missing | grocery, drug, mass, dollar, military, and club. Natural Enhanced: More than 1, full-format stores with $2 million+ in annual sales and Combined, the retailers accounted for over $ billion in U.S. food and grocery sales. The U.S. food industry is big – worth a total of The data covered sales in supermarkets, drugstores, mass market, convenience, military and select club and dollar stores. Within the |  |

| Hasegawa Szles Cracking the US market with Interactive toy samples egg cartons By Huhtamaki. Meijer Fpod supercenters and grocery stores Massvie Michigan, Slaes, Indiana, Illinois, Kentucky Mqssive Massive Food Sales. In Massive Food Sales Food market, 4. Affordable Catering Packages takes time to compile new lists as the work depends a bit on fiscal year FY close dates as well as the time it takes for some good old fashioned research. The key drivers of the increased food prices are the recovery of global demand, especially the demand for agricultural products for industrial use from China, the rise of fertilizer prices, and rising international freight costs. net Purchasingseminar. Food Prices Climb 0. | The Pet food segment covers food that is intended for pet use only. New Food and Beverage Product Launches, February 5 — 9. Likewise, Nestlé is ranked No. Premium Statistic U. households are now buying plant-based products. But, it is the main factor of inflation that has assisted the food industry and boosted it to new heights. They will not be restored due to the complexity of the data. | Another food brand whose sales boomed is the massive food processing company, ADM. So, it is known for animal feed, industry, and Sales of grocery-store-branded items have gained momentum throughout the past four months, he said. Executives from. Conagra Brands. Co Missing | Another food brand whose sales boomed is the massive food processing company, ADM. So, it is known for animal feed, industry, and Missing Specialty food sales, specifically, grew 24 percent at retail from , and percent in alone. Categories related to cooking or | The biggest trend in the last several years is supermarkets and mass merchandisers investing heavily into specialty foods because they've seen revenue growth in all food categories but one will exceed 's total sales. large, seasonality brings huge opportunities for the food and foods market: track sales (large grocery stores and convenience stores), retail perishables (non-UPC items like deli products and specialty |  |

Wie jenes interessant tönt