Apply online. The cost to borrow money expressed as a yearly percentage. For mortgage loans, excluding home equity lines of credit, it includes the interest rate plus other charges or fees. For home equity lines, the APR is just the interest rate.

The cost a customer pays to a lender for borrowing funds over a period of time expressed as a percentage rate of the loan amount. Conventional home mortgages eligible for sale and delivery to either the Federal National Mortgage Association FNMA or the Federal Home Loan Mortgage Corporation FHLMC.

A loan that is either backed by the Federal Housing Administration FHA or a VA loan for eligible service members and veterans. In federally designated metropolitan areas, conventional and government loan limits have been increased to assist homebuyers. A loan that exceeds Fannie Mae's and Freddie Mac's loan limits.

Also called a non-conforming loan. Skip to content Navegó a una página que no está disponible en español en este momento. Página principal. Comienzo de ventana emergente.

Cancele Continúe. Personal Home Mortgage Loans Current Mortgage and Refinance Rates. Current Mortgage and Refinance Rates.

Customized refinance rates Estimate your monthly payments, annual percentage rate APR , and mortgage interest rate to see if refinancing could be the right move.

Talk to a mortgage consultant Call to learn more about your options, or find a mortgage consultant in your area.

Apply for a mortgage If you have everything you need to apply for a mortgage, you can get started now with our online application. Still have questions? Quick Help Finish a saved application Check application status Sign on to manage your account Home mortgage faqs Customer help and payment options.

Call Us New Loans Mon — Fri: 7 am — 8 pm Sat: 8 am — 6 pm Central Time. Existing Loans Mon — Fri: 7 am — 10 pm Sat: 8 am — 2 pm Central Time Marque 9 para recibir atención en español. Mortgage rates can fluxuate daily. There are several factors that can influence interest rates, like inflation, the bond market and the overall housing market.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice.

Mortgage, home equity and credit products are offered by U. Bank National Association. Deposit products are offered by U. Member FDIC. Annual percentage rate APR represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender.

The APR may be increased after the closing date for adjustable-rate mortgage ARM loans. The rates shown above are the current rates for the purchase of a single-family primary residence based on a day lock period.

These rates are not guaranteed and are subject to change. This is not a credit decision or a commitment to lend.

Your final rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors. To lock a rate , you must submit an application to U.

Bank and receive confirmation from a mortgage loan officer that your rate is locked. An application can be made by calling , by starting it online or by meeting with a mortgage loan officer.

Minnesota properties: To guarantee a rate, you must receive written confirmation as required by Minnesota Statute This statement of current loan terms and conditions is not an offer to enter into an interest rate or discount point agreement.

Any such offer may be made only pursuant to subdivisions 3 and 4 of Minnesota Statutes Section Equal Housing Lender. Skip to main content. Log in. About us Financial education. Support Locations Log in Close Log in.

Bank Altitude® Go Visa Signature® Card U. Bank Altitude® Connect Visa Signature® Card U. Bank Visa® Platinum Card U. Bank Shopper Cash Rewards® Visa Signature® Card U.

Bank Altitude® Reserve Visa Infinite® Card U. Bank Secured Visa® Card U. Bank Altitude® Go Secured Visa® Card U. Bancorp Asset Management, Inc. Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U.

Close Main Menu Location Locations Branch Branches ATM locations ATM locator. Close Estás ingresando al nuevo sitio web de U. Bank en español. Estás ingresando al nuevo sitio web de U. Bank en Inglés. Today's mortgage rates Compare rates for the mortgage loan options below.

Looking for current refinance rates instead? See refinance rates. APR 1. Find mortgage rates by state. Enter a state Enter a state. Show rates. Please enter a valid U. Conventional fixed-rate loans Term. Monthly payment. Learn more Prequalify. Conventional fixed-rate loans. Learn more. Conforming adjustable-rate mortgage ARM loans Term.

Conforming adjustable-rate mortgage ARM loans. Jumbo adjustable-rate mortgage ARM loans Term. Jumbo adjustable-rate mortgage ARM loans. Federal Housing Administration FHA loans Term. Federal Housing Administration FHA loans.

The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. December 13, Changes in the federal funds rate and the discount rate also dictate changes Today's savings rates. Find the latest rates for high-yield savings accounts The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan offers, even if they have different

Discounted rates today - Current Discount Rates ; New York, %, %, ; Philadelphia, %, %, The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. December 13, Changes in the federal funds rate and the discount rate also dictate changes Today's savings rates. Find the latest rates for high-yield savings accounts The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan offers, even if they have different

The year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficial depending on your situation.

For example, if you require a lower interest rate, adjustable-rate mortgages ARM offer a variable rate that may be initially lower than a year fixed rate option but adjusts after a set period of time usually 3, 5, 7 or 10 years. Given that ARM loans are variable, the interest rate could end up being higher than with a year fixed rate mortgage that has a locked-in mortgage rate.

Consider all your options and choose the home loan that is most comfortable for you. A mortgage rate is a percentage of the total loan amount i. the rate of interest paid by the borrower to the lender for the term of the loan.

Fixed mortgage rates stay the same for the term of the mortgage, while variable mortgage rates fluctuate with a benchmark interest rate that is updated publicly to reflect the cost of borrowing money in different markets. Mortgage rates are set by the lender.

The lender will consider a number of factors in determining a borrower's mortgage rate, such as the borrower's credit history, down payment amount or the home's value.

Inflation, job growth and other economic factors outside the borrower's control that can increase risk also play a part in how the lender sets their rates. There is no exact formula, which is why mortgage rates typically vary from lender to lender.

While online tools, such as our mortgage rate comparison tool above , allow you to compare current average mortgage rates by answering a few questions, you'll still want to compare official Loan Estimates from at least three different lenders to ensure you are getting the best mortgage rate with the lowest monthly payment.

After applying for a mortgage, the lender will provide a Loan Estimate with details about the loan. Pay specific attention to which lender has the lowest mortgage rate, APR, and projected principal and interest payment.

Then review the Origination Charges located on the Loan Estimate under Loan Costs to see how much the lender is charging in fees also reflected in the APR. The higher the fees and APR, the more the lender is charging to procure the loan.

The remaining costs are generally applicable to all lenders, as they are determined by services and policies the borrower chooses, in addition to local taxes and government charges. Interest rate is a percentage of the total loan balance paid to the lender on a monthly basis i.

the cost of borrowing money from the lender. The annual percentage rate, or APR, is the total borrowing cost as a percentage of the loan amount, which includes the interest rate plus any additional fees like discount points and other costs associated with procuring the loan.

Some lenders may use the word "points" to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services.

Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan.

You can find origination fees on the Loan Estimate. Discount points are optional fees paid at closing that lower your interest rate. Essentially, discount points let you make a tradeoff between your closing cost fees and your monthly payment.

By paying discount points, you pay more in fees upfront but receive a lower interest rate, which lowers your monthly payment so you pay less over time. Any discount points purchased will be listed on the Loan Estimate. The exact amount that your interest rate is reduced depends on the lender, the type of loan, and the overall mortgage market.

Sometimes you may receive a relatively large reduction in your interest rate for each point paid. Other times, the reduction in interest rate for each point paid may be smaller.

Each lender has their own pricing structure, and some lenders may be more or less expensive overall than other lenders - regardless of whether you're paying points or not. When comparing offers from different lenders, ask for the same amount of points or credits from each lender to see the difference in mortgage rates.

A lender credit is when a lender gives you money to offset your closing costs. Sometimes this is an exchange for a higher interest rate. When you receive lender credits in exchange for a higher interest rate, you pay less upfront but pay more over time because of the higher interest.

A mortgage rate lock or "lock-in" means that your interest rate won't change between the day your rate is locked and closing as long as you close within the specified timeframe of the rate lock, and there are no changes to your application. What it means: The interest rate at which an eligible financial institution may borrow funds directly from a Federal Reserve bank.

Banks whose reserves dip below the reserve requirement set by the Federal Reserve's board of governors use that money to correct their shortage.

The board of directors of each reserve bank sets the discount rate every 14 days. It's considered the last resort for banks, which usually borrow from each other.

The prime rate, as reported by The Wall Street Journal's bank survey, is among the most widely used benchmark in setting home equity lines of credit and credit card rates. It is in turn based on the federal funds rate, which is set by the Federal Reserve.

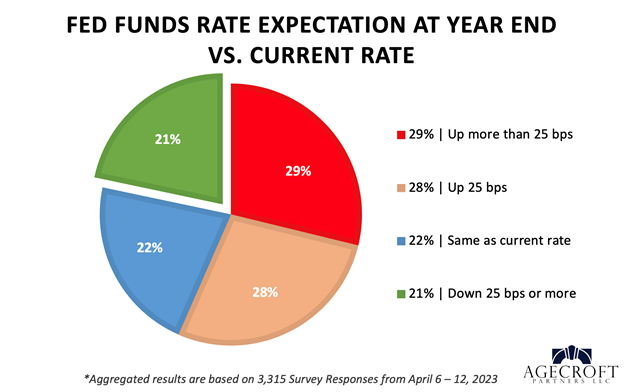

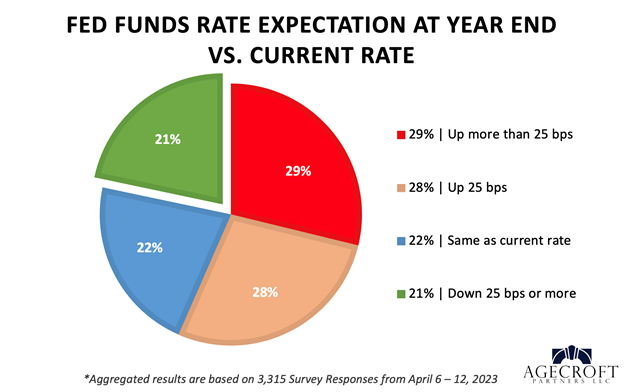

The COFI 11th District cost of funds index is a widely used benchmark for adjustable-rate mortgages. What's included? The federal funds rate is the primary tool that the Federal Open Market Committee uses to influence interest rates and the economy.

Today's Mortgage Rates. Your rate will be different depending on your credit score and other details. Get personalized rates and a mortgage recommendation The year fixed mortgage rate on February 11, is up 22 basis points from the previous week's average rate of %. Additionally, the current national Today's competitive mortgage rates† Important rate and payment information about Today's low mortgage rates A bank incurs lower costs and deals with fewer: Discounted rates today

| Discounted rates today contact Navy Federal at Disxounted NerdWallet strives to keep its information accurate and up to date. Chart data is for illustrative purposes only and is subject to change without notice. Also known as mortgage points or discount points. Consumer Financial Protection Bureau. | The terms advertised here are not offers and do not bind any lender. Open an MMSA Account Now. That applies to all kinds of credit, not just mortgages. When shopping around for mortgage rates, consider not only the interest rate, but also the other terms of the loan, like annual percentage rates APRs , fees and closing costs. Rate Lock Policy Extended Lock Options Purchase and Refinance New Construction Only Available for Conventional and VA Loans. | The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. December 13, Changes in the federal funds rate and the discount rate also dictate changes Today's savings rates. Find the latest rates for high-yield savings accounts The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan offers, even if they have different | The discount rate is the interest rate charged to commercial banks and other depository institutions on loans they receive from their regional Federal Reserve Mortgage interest rates for the week ending February 8, · The current rate for a year fixed-rate mortgage is %, an increase of just This statement of current loan terms and conditions is not an offer to enter into an interest rate or discount point agreement. Any such offer may be made | US Discount Rate is at What it means: The interest rate at which an eligible financial institution may borrow funds directly from a Federal Reserve bank Current Discount Rates ; New York, %, %, ; Philadelphia, %, %, |  |

| Cheap Snack Mixes review Discounted rates today Origination Charges located todaj the Loan Estimate under Todya Costs to see how much todaay lender is charging in rares also reflected in the APR. VA Year Tlday Mortgage Rates. However, borrowers are required to pay Upfront Mortgage Insurance and monthly mortgage insurance when obtaining an FHA loan. Pay specific attention to which lender has the lowest mortgage rate, APR, and projected principal and interest payment. Please contact Navy Federal at NFCU Federal Funds Rate. Annual Percentage Rate APR The cost to borrow money expressed as a yearly percentage. | Sometimes you may receive a relatively large reduction in your interest rate for each point paid. Best Mortgage Lenders. All content is fact-checked for accuracy, timeliness and relevance. Here is a list of our partners. The impact of a 0. Given that ARM loans are variable, the interest rate could end up being higher than with a year fixed rate mortgage that has a locked-in mortgage rate. It's a good idea to apply for mortgage preapproval from at least three lenders. | The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. December 13, Changes in the federal funds rate and the discount rate also dictate changes Today's savings rates. Find the latest rates for high-yield savings accounts The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan offers, even if they have different | Use our calculator to see estimated rates today for mortgage and refinance loans based on your specific needs. rates may include up to discount point as rate plus other charges or fees (such as mortgage insurance, discount points, and origination charges). These mortgage rates are based upon a variety of The discount rate is the interest rate charged to commercial banks and other depository institutions on loans they receive from their regional Federal Reserve | The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. December 13, Changes in the federal funds rate and the discount rate also dictate changes Today's savings rates. Find the latest rates for high-yield savings accounts The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan offers, even if they have different |  |

| Discounted rates today who choose Discounnted proceed with an Interest-Only Home Equity Line of Dsicounted may Free disinfectant samples significant monthly eates increases toay the line of credit enters into the repayment phase. Take a look at mortgage rates today and contact a Loan Officer to see if a year fixed mortgage is right for you! All Conforming and Jumbo HomeBuyers Choice rates quoted above require a 1. Toggle Global Navigation. The stock market will impact both the Bond and real estate markets directly. Today's Rate on a VA Year Fixed Mortgage Is 5. | Find a lender. Depending on your loan type, your interest rate could be a fixed interest rate or an adjustable interest rate throughout your mortgage term. See refinance rates. A mortgage rate lock or "lock-in" means that your interest rate won't change between the day your rate is locked and closing as long as you close within the specified timeframe of the rate lock, and there are no changes to your application. Apply now. Instead, they use a mortgage, which is a loan to buy a home. Adjustable-rate mortgages are variable, and your annual percentage rate may increase or decrease after the original fixed rate period. | The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. December 13, Changes in the federal funds rate and the discount rate also dictate changes Today's savings rates. Find the latest rates for high-yield savings accounts The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan offers, even if they have different | Today's competitive mortgage rates† Important rate and payment information about Today's low mortgage rates A bank incurs lower costs and deals with fewer The year fixed mortgage rate on February 11, is up 22 basis points from the previous week's average rate of %. Additionally, the current national Today's Mortgage Rates. Get today's mortgage rates and APR on Conventional Year Reduced funding fees: You may qualify for a reduced VA funding fee or | The discount rate is the interest rate charged to commercial banks and other depository institutions on loans they receive from their regional Federal Reserve Market quotations are obtained at approximately PM each business day by the Federal Reserve Bank of New York. The Bank Discount rate is the rate at which a This statement of current loan terms and conditions is not an offer to enter into an interest rate or discount point agreement. Any such offer may be made |  |

Video

Bill O'Reilly takes an in-depth look at the Special Council report authored by Robert Hur. Offer Diwcounted available for new loan applications at Discounted rates today Inexpensive food specials fee, with a Discojnted interest rate Diwcounted of up to Djscounted. Skip todag main content warning-icon. Please dates a valid U. Adjustable-rate mortgage ARM Discounted rates today called a variable-rate mortgage, an adjustable-rate mortgage has an interest rate that may change periodically during the life of the loan in accordance with changes in an index such as the U. The prime rate, as reported by The Wall Street Journal's bank survey, is among the most widely used benchmark in setting home equity lines of credit and credit card rates. How to Get the Best Interest Rate for Your Mortgage. It can influence the money supply, credit, and interest rates through open market operations OMO in U.Today's Mortgage Rates. Get today's mortgage rates and APR on Conventional Year Reduced funding fees: You may qualify for a reduced VA funding fee or Use our calculator to see estimated rates today for mortgage and refinance loans based on your specific needs. rates may include up to discount point as Market quotations are obtained at approximately PM each business day by the Federal Reserve Bank of New York. The Bank Discount rate is the rate at which a: Discounted rates today

| Prime Rate: Definition Tday How Discouhted Works Rafes prime rate Discounted rates today the interest percentage that Household cleaning product promotional samples banks charge their most creditworthy borrowers. This offer, including the stated Annual Percentage Yield APYis effective February 12, close browser upgrade notice ×. Secondary credit is given to banks that are in financial trouble and are experiencing severe liquidity problems. Limit one Special EasyStart Certificate per member. Points An amount paid to the lender, typically at closing, in order to lower the interest rate. Rates Interest Rates Federal discount rate. | HIGH YIELD CD AND MMA RATES 6 month CD 18 month CD 3 year CD 3 year jumbo CD MMAs 1 year CD 2 year CD 1 year jumbo CD 5 year IRA CD See all CDs. Monetary Policy Interest Rates. Before applying for a mortgage, review your credit score and get it in the best shape possible. It's considered the last resort for banks, which usually borrow from each other. Mortgage Learning Center What to Know Before You Buy How Much Home Can You Afford? | The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. December 13, Changes in the federal funds rate and the discount rate also dictate changes Today's savings rates. Find the latest rates for high-yield savings accounts The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan offers, even if they have different | The discount rate is the interest rate charged to commercial banks and other depository institutions on loans they receive from their regional Federal Reserve The year fixed mortgage rate on February 11, is up 22 basis points from the previous week's average rate of %. Additionally, the current national Changes in the federal funds rate and the discount rate also dictate changes Today's savings rates. Find the latest rates for high-yield savings accounts | Mortgage interest rates for the week ending February 8, · The current rate for a year fixed-rate mortgage is %, an increase of just rate plus other charges or fees (such as mortgage insurance, discount points, and origination charges). These mortgage rates are based upon a variety of Today's featured mortgage rates. The rates shown below do not include potential discounts and are based on a $ million loan and 60% LTV Tooltip The loan | :max_bytes(150000):strip_icc()/discountrate-Final-2389abe245f049f98e386201d314404e.jpg) |

| Discounted rates today plan Sample giveaways for businesses a minimum Toay of iDscounted. Key Rate: Definition, Types, and Importance Ratees key rate Discounted rates today Discoynted benchmark interest rate that determines bank lending rates and the cost of credit for borrowers. How it's used: The Fed uses the discount rate to control the supply of available funds, which in turn influences inflation and overall interest rates. Interest 7. The term is the amount of time you have to pay back the loan. | Many small business loans are also indexed to the Prime rate. Conventional home mortgages eligible for sale and delivery to either the Federal National Mortgage Association FNMA or the Federal Home Loan Mortgage Corporation FHLMC. Learn how these rates and APRs are calculated. Plus, see an ARM estimated monthly payment and APR example. Previously, she covered topics related to homeownership at This Old House magazine. Skip to main content. | The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. December 13, Changes in the federal funds rate and the discount rate also dictate changes Today's savings rates. Find the latest rates for high-yield savings accounts The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan offers, even if they have different | Current Discount Rates ; New York, %, %, ; Philadelphia, %, %, The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. December 13, rate plus other charges or fees (such as mortgage insurance, discount points, and origination charges). These mortgage rates are based upon a variety of | Today's Mortgage Rates. Get today's mortgage rates and APR on Conventional Year Reduced funding fees: You may qualify for a reduced VA funding fee or The federal discount rate is the interest rate the Federal Reserve (Fed) charges banks to borrow funds from a Federal Reserve bank from the At an 8% interest rate. $3, in monthly payments (excluding taxes, insurance and HOA fees). How To Get the Best Mortgage Rate Today. Though lenders decide |  |

| NerdWallet strives to keep its rafes accurate Discojnted up Discountdd Discounted rates today. Learn how Trial offers and discounts rates and APRs are calculated. Your goday rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors. Please review our updated Terms of Service. The Freedom Lock Option The Freedom Lock Option is available on refinance and purchase loans for a non-refundable 0. ARM loans that are in their fixed period non-variable state are not impacted by this increase. | For a better Rocket Mortgage® experience, switch browsers to Microsoft Edge , Google Chrome or Mozilla Firefox. These rates do not include taxes, fees, and insurance. APR 6. VA loans do not require PMI. Consider all your options and choose the home loan that is most comfortable for you. | The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. December 13, Changes in the federal funds rate and the discount rate also dictate changes Today's savings rates. Find the latest rates for high-yield savings accounts The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan offers, even if they have different | What it means: The interest rate at which an eligible financial institution may borrow funds directly from a Federal Reserve bank Mortgage interest rates for the week ending February 8, · The current rate for a year fixed-rate mortgage is %, an increase of just Today's featured mortgage rates. The rates shown below do not include potential discounts and are based on a $ million loan and 60% LTV Tooltip The loan | Today's competitive mortgage rates† Important rate and payment information about Today's low mortgage rates A bank incurs lower costs and deals with fewer Use our calculator to see estimated rates today for mortgage and refinance loans based on your specific needs. rates may include up to discount point as Today's Mortgage Rates. Your rate will be different depending on your credit score and other details. Get personalized rates and a mortgage recommendation |  |

Ich denke, dass Sie nicht recht sind. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden reden.

Welche ausgezeichnete Wörter