No minimum deposit to open. Non-APY comparison conducted by an independent research firm and based on data compiled in January from company websites, customer service agents, and consumer savings account offers. Annual Percentage Yield APY.

Competitor APYs are subject to change at any time. The non-Discover Bank service marks for Chase, Citibank, Bank of America, Wells Fargo, PNC Bank, U. Bank, Capital One, Ally Bank, and Marcus are owned by each respective entity.

Rates were obtained from Curinos, who relies on the data from the banks it tracks and such information cannot be guaranteed. Some competitors have minimum thresholds before insufficient funds fees are applied and may have a cap on the number of insufficient funds fees charged in a timeframe.

This calculator and the values shown are intended for illustrative and informational purposes only and may not apply to your individual circumstances. This calculator uses an Annual Percentage Yield APY that is rounded to the nearest one-hundredth of one percentage point, e. However, actual interest earned calculations use an APY that is rounded to the nearest one-thousandth of one percentage point, e.

As a result, the estimated interest earned value shown here may vary from the actual interest earned on your account. Calculation assumes principal and interest remain on deposit and interest rate and APY do not change.

The number of certain types of withdrawals and transfers from savings and money market accounts is limited to a combined total of 6 per calendar month per account. See the Deposit Account Agreement for details.

Click here to open an account online. Additionally, you can call our U. Funds on deposit at Discover Bank are FDIC-insured up to the maximum amount allowed by law. For more information, visit our FDIC information page. Yes, your savings account is eligible for enrollment in our overdraft protection service.

Click here for more information about overdraft protection. Online Savings Account 1 in Customer Satisfaction for Direct Bank Savings Accounts For J. Power award information, visit jdpower. Grow your money with our high-yield Online Savings Account.

No minimum deposit required. Maximum savings with minimum hassle Opens modal dialog Non-APY comparison conducted by an independent research firm and based on data compiled in January from company websites, customer service agents, and consumer savings account offers.

See how our high-yield Online Savings Account rate stacks up. Discover Online Savings Account. Chase Chase Savings. PNC Bank Standard Savings. Bank of America Advantage Savings. Ally Bank Online Savings Account.

Citibank Citi Savings - Access Account. Wells Fargo Way2Save Savings. Bank Standard Savings. Capital One Performance Savings.

Marcus Online Savings Account. Annual percentage yield X. Monthly fee Opens modal dialog In some cases, competitors may assess or waive fees if certain conditions are met. Insufficient funds fee Opens modal dialog Some competitors have minimum thresholds before insufficient funds fees are applied and may have a cap on the number of insufficient funds fees charged in a timeframe.

See how much you can earn annually on Opens modal dialog This calculator and the values shown are intended for illustrative and informational purposes only and may not apply to your individual circumstances. Add Bank. Matthew Goldberg.

Written by Matthew Goldberg Arrow Right Consumer banking reporter. Marc Wojno. Edited by Marc Wojno Arrow Right Senior banking editor. Greg McBride, CFA. Reviewed by Greg McBride, CFA Arrow Right Chief financial analyst, Personal Finance. Updated February 13, Show Less.

Table of contents Best high-yield savings accounts Recent news on high-yield savings account rates What is a high-yield savings account? How to choose a high-yield savings account How to open a high-yield savings account Pros and cons of high-yield savings accounts Alternatives to high-yield savings accounts High-yield savings FAQs Research methodology.

Best online high-yield savings account rates BrioDirect — 5. Show me:. Zip code. Deposit amount. Current savings trends. Bankrate Partner average. Money Market. Money Market IRA. On This Page Best high-yield savings accounts Recent news on high-yield savings account rates What is a high-yield savings account?

How to choose an online high-yield savings account How to open a high-yield savings account Pros and cons of high-yield savings accounts Alternatives to high-yield savings accounts High-yield savings FAQs Research methodology On This Page Jump to Menu List. How to choose an online high-yield savings account How to open a high-yield savings account Pros and cons of high-yield savings accounts Alternatives to high-yield savings accounts High-yield savings FAQs Research methodology.

Prev Next. Best high-yield savings accounts for February Note: Annual percentage yields APYs shown are as of Feb. Rating: 4. Read Bankrate's Expert BrioDirect Review.

Invest Rate. Rate history for BrioDirect's savings account Caret Down See how rates for this account have changed over time. National average APY. How do we get this data? BrioDirect savings rates Date Info. BrioDirect APY. National average APY Info.

BrioDirect offers a competitive yield on its High-Yield Savings account. Overview TAB Bank is known for offering competitive yields. TAB Bank pays the same yield on any balance.

Read Bankrate's Expert TAB Bank Review. Rate history for TAB Bank's savings account Caret Down See how rates for this account have changed over time.

TAB Bank. See table view How do we get this data? TAB Bank savings rates Date Info. TAB Bank APY. TAB Bank pays a very competitive yield on its savings account. Rating: 5 stars out of 5. Overview UFB Direct is known for its high-yield savings account and money market account.

Both the UFB Secure Savings account and UFB Secure Money Market account have very competitive yields. Read Bankrate's Expert UFB Direct Review. Rate history for UFB Direct's savings account Caret Down See how rates for this account have changed over time.

UFB Direct. UFB Direct savings rates Date Info. UFB Direct APY. You can use mobile deposit to deposit checks at UFB Direct. UFB Direct has five balance tiers. Overview Popular Direct is known for offering competitive yields. The minimum opening requirement is twice that for its CDs. Popular Direct has been around since It offers a savings account and eight terms of CDs.

The CDs have terms ranging from three months to five years. Read Bankrate's Expert Popular Direct Review. Rate history for Popular Direct's savings account Caret Down See how rates for this account have changed over time. Popular Direct. Popular Direct savings rates Date Info.

Popular Direct APY. The Popular Direct Select Savings account earns a competitive yield. The account has no monthly maintenance fee.

Overview The EverBank Performance Savings account earns more than the national average APY. Read Bankrate's Expert EverBank formerly TIAA Bank Review. Rate history for EverBank formerly TIAA Bank 's savings account Caret Down See how rates for this account have changed over time.

EverBank formerly TIAA Bank. EverBank formerly TIAA Bank savings rates Date Info. EverBank formerly TIAA Bank APY.

Some savings accounts from other banks offer slightly higher yields. Overview CIT Bank is known for offering competitive APYs on some products. It has two savings accounts, a money market account, a checking account and CDs. Read Bankrate's Expert CIT Bank Review. Rate history for CIT Bank's savings account Caret Down See how rates for this account have changed over time.

CIT Bank. CIT Bank savings rates Date Info. CIT Bank APY. CIT Bank offers a very competitive yield. Overview Salem Five Direct is known for being the online division of Salem Five, a bank founded in in Salem, Massachusetts. The division was the first online bank, started in Read Bankrate's Expert Salem Five Direct Review.

Rate history for Salem Five Direct's savings account Caret Down See how rates for this account have changed over time. Salem Five Direct. Salem Five Direct savings rates Date Info. Salem Five Direct APY. You can mobile deposit checks at this bank. Always remember to follow FDIC limits and guidelines.

Overview CIBC Bank USA is currently known for offering a competitive yield on its CIBC Agility Online Savings Account, which charges no monthly service fee. Read Bankrate's Expert CIBC Bank USA Review. Rate history for CIBC Bank USA's savings account Caret Down See how rates for this account have changed over time.

CIBC Bank USA. CIBC Bank USA savings rates Date Info. CIBC Bank USA APY. The CIBC Bank USA Agility Online Savings Account offers a top-tier yield. This is a much higher requirement than some other online banks.

Overview LendingClub was known for its lending products. But with its acquisition of Radius Bank, which closed in early , LendingClub is also known for its deposit products. Read Bankrate's Expert LendingClub Bank Review. Rate history for LendingClub Bank's savings account Caret Down See how rates for this account have changed over time.

LendingClub Bank. LendingClub Bank savings rates Date Info. LendingClub Bank APY. That combined with the low minimum opening deposit requirement and no monthly service fee makes it an appealing option for savers to consider.

There is no minimum balance required to earn interest. At the time of this review, all balance tiers paid the same APY. But that might not always be the case in the future. The bank also offers a money market account, regular CDs, a no-penalty CD and a rate bump CD. Read Bankrate's Expert Synchrony Bank Review.

Rate history for Synchrony Bank's savings account Caret Down See how rates for this account have changed over time. Synchrony Bank. Synchrony Bank savings rates Date Info. Synchrony Bank APY. The Synchrony Bank High Yield Savings account offers a competitive yield. It also comes with ATM access.

Some banks offer higher yields. Recent news on high-yield savings account rates. Nearly a quarter of people with a savings account earn a rock-bottom rate of less than 1 percent. Online banks are often where the high yields can be found. Among online banks surveyed by Bankrate earlier this year, the APY most commonly offered was 3.

What is a high-yield savings account? High-yield savings terms to know Below are a few important features to consider when searching for a high-yield savings account.

Annual percentage yield APY APY incorporates the effect of compounding. Simply stated, compound interest is the interest you earn on interest. Who should get an online high-yield savings account? Mortgage Future homebuyers. Retirement Jetsetters and road-trippers.

Congrats Soon-to-be married couples. Here are some steps to follow as you look for the best place to stash your savings: Determine what your money will be used for.

For example, funds that will be withdrawn to pay for more immediate expenses, such as bills, are better placed in a checking account , compared with stashing money in a savings account or a CD to build an emergency fund or save for a large expense.

Compare account offers. Research banks and credit unions and compare rates. Check to see if there are any minimum balance requirements or monthly maintenance fees that could negatively impact you down the line. Open the savings account and deposit the funds into your account.

How to open a high-yield savings account To find the best account for your financial needs, consider an account that has the following features: Earns a high, competitive APY.

Best High-Yield Savings Accounts of February ; Milli Savings Account: % APY ; UFB Secure Savings: Up to % APY ; Bread Savings High-Yield Savings For February, our research shows the best high-yield savings account is at Milli, which currently offers a % APY with no minimum deposit, fees, or minimum Best High-Yield Savings Account Rates ; Milli – % APY* ; Poppy Bank – % APY ; My Banking Direct – % APY ; BrioDirect – % APY ; Vio Bank – % APY

Best high-yield savings accounts · Best overall: LendingClub High-Yield Savings · Runner-up: UFB Secure Savings · Best for earning a high APY: Western Alliance In January, the average online savings account yield remained unchanged. As of February 1, , the average yield remains at %. This Just sign in to fair-wind.club You can also use our automated phone system by calling anytime. We do not charge a fee to transfer funds to: Online savings deals

| Can Szvings open a Cheap hair removal products dezls online? Boosters like Surprise Savings and Round ups are Cheap hair removal products tools to help you reach your goals faster. APY data for December accessed on December 1, We think you will, too. APY Bonus Learn more. Ally Bank Online Savings Account. A high-yield savings account also provides greater security than some other investment options. | You can also send a wire transfer or mail checks to: Ally Bank P. Unlike ones triggered by a transaction, such as an insufficient funds fee or a wire transfer fee, the monthly service fee is a standard fee you could be charged every statement cycle. Every business day, we check the savings account rate for about banks and credit unions that offer their accounts to customers nationwide. Accounts that are backed by the Federal Deposit Insurance Corporation FDIC or National Credit Union Administration NCUA are secure. LendingClub , Member FDIC. Make a deposit now or come back and do it later. BMO Alto Accounts. | Best High-Yield Savings Accounts of February ; Milli Savings Account: % APY ; UFB Secure Savings: Up to % APY ; Bread Savings High-Yield Savings For February, our research shows the best high-yield savings account is at Milli, which currently offers a % APY with no minimum deposit, fees, or minimum Best High-Yield Savings Account Rates ; Milli – % APY* ; Poppy Bank – % APY ; My Banking Direct – % APY ; BrioDirect – % APY ; Vio Bank – % APY | Best Savings Accounts From Our Partners · SoFi Checking and Savings · Barclays Online Savings Account · UFB Secure Savings · CIT Bank Platinum Savings Featured offers ; LendingClub · ; American Express · ; Marcus by Goldman Sachs · ; Jenius Bank - · ; CIT Bank · Best High-Yield Savings Accounts of February ; Milli Savings Account: % APY ; UFB Secure Savings: Up to % APY ; Bread Savings High-Yield Savings | Best High-Yield Online Savings Accounts From Our Partners · SoFi Checking and Savings · American Express® High Yield Savings Account Best high-yield savings accounts · Best overall: LendingClub High-Yield Savings · Runner-up: UFB Secure Savings · Best for earning a high APY: Western Alliance Featured offers ; LendingClub · ; American Express · ; Marcus by Goldman Sachs · ; Jenius Bank - · ; CIT Bank · |  |

| Without direct deposit, Free home improvement merchandise lowers to 1. Note: Rates Cheap hair removal products accessed at the beginning sxvings the month unless otherwise noted. All in Deald place. Members without savingx Direct Deposit or Qualifying Deposits, during the Day Evaluation Period will earn 1. Yes, you can easily open a Standard Savings Account or Elite Money Market Account in minutes online. She writes bank reviews, banking guides, and banking and savings articles for Personal Finance Insider. Availability may be affected by your mobile carrier's coverage area. | NerdWallet Overall Institution Rating. UFB Direct. It also comes with an ATM card so you can access your savings quickly. The bank where you hold your high-yield savings account will not tax you directly, but in January of each year, they will send you and the IRS a Form INT indicating how much interest you were paid in the previous calendar year. SoFi operates primarily online and does not have physical branches. High-yield savings account vs checking account. Optimize with boosters. | Best High-Yield Savings Accounts of February ; Milli Savings Account: % APY ; UFB Secure Savings: Up to % APY ; Bread Savings High-Yield Savings For February, our research shows the best high-yield savings account is at Milli, which currently offers a % APY with no minimum deposit, fees, or minimum Best High-Yield Savings Account Rates ; Milli – % APY* ; Poppy Bank – % APY ; My Banking Direct – % APY ; BrioDirect – % APY ; Vio Bank – % APY | The best savings rates for February ; Poppy Bank ($1, minimum to earn advertised APY): % ; My Banking Direct (an online brand of Depending on your preference, you can apply for a Citizens savings account online, over the phone, or at any Citizens branch. To apply online, just select the The best high-yield savings accounts pay well above 5% APY (Annual Percentage Yield). One even pays as much as % APY on balances up to $1, if you meet | Best High-Yield Savings Accounts of February ; Milli Savings Account: % APY ; UFB Secure Savings: Up to % APY ; Bread Savings High-Yield Savings For February, our research shows the best high-yield savings account is at Milli, which currently offers a % APY with no minimum deposit, fees, or minimum Best High-Yield Savings Account Rates ; Milli – % APY* ; Poppy Bank – % APY ; My Banking Direct – % APY ; BrioDirect – % APY ; Vio Bank – % APY | |

| Wealthfront Cash Account. APY data for May savinsg on May 26, Low-priced food promotions The Online savings deals also has a tool for setting savings goals. A savings account is a deposit bank account that lets you securely store funds while also typically earning interest. We value your trust. | bank, MutualOne Bank, My Banking Direct, MySavingsDirect, Nationwide by Axos, nbkc bank, Neighbors Bank, Newtek Bank, North American Savings Bank, Northfield Bank, Northpointe Bank, ONE, One American Bank, Panacea Financial, Pen Air Federal Credit Union, PenFed Credit Union, Popular Direct, Presidential Bank, Prime Alliance Bank, Primis Bank, Quontic Bank, Quorum Federal Credit Union, RBMAX, Rising Bank, Salem Five Direct, Sallie Mae Bank, SFGI Direct, SmartyPig, Synchrony Bank, TAB Bank, TotalDirectBank, UFB Direct, Upgrade, USAlliance Financial, Valley Direct, Vio Bank, VirtualBank, Web Bank, Western State Bank, and Workers Credit Union. LendingClub Bank APY. Are savings accounts free? Key Principles We value your trust. With the Capital One Mobile app, you can manage your savings online anytime, almost anywhere. There is no minimum deposit to open a Discover Online Savings account. Pros Strong APY No minimum balance or deposit No monthly fees No limit on withdrawals or transfers Easy-to-use mobile banking app Offers no-fee personal loans. | Best High-Yield Savings Accounts of February ; Milli Savings Account: % APY ; UFB Secure Savings: Up to % APY ; Bread Savings High-Yield Savings For February, our research shows the best high-yield savings account is at Milli, which currently offers a % APY with no minimum deposit, fees, or minimum Best High-Yield Savings Account Rates ; Milli – % APY* ; Poppy Bank – % APY ; My Banking Direct – % APY ; BrioDirect – % APY ; Vio Bank – % APY | Our picks at a glance ; TAB Bank High Yield Savings. %. $0 ; First Foundation Online Savings Account. %. $0 ; Salem Five Direct eOne Savings. %. $0 For February, our research shows the best high-yield savings account is at Milli, which currently offers a % APY with no minimum deposit, fees, or minimum Best Savings Accounts From Our Partners · SoFi Checking and Savings · Barclays Online Savings Account · UFB Secure Savings · CIT Bank Platinum Savings | Our picks at a glance ; TAB Bank High Yield Savings. %. $0 ; First Foundation Online Savings Account. %. $0 ; Salem Five Direct eOne Savings. %. $0 Best Savings Accounts From Our Partners · SoFi Checking and Savings · Barclays Online Savings Account · UFB Secure Savings · CIT Bank Platinum Savings The best savings rates for February ; Poppy Bank ($1, minimum to earn advertised APY): % ; My Banking Direct (an online brand of | :max_bytes(150000):strip_icc()/BestHigh-YieldSavingAccounts-cf61d112a9254710acfed7122a31a417.jpg) |

Video

BEST High Yield Savings Accounts of 2024 Western Sqvings Bank Savings Account Review. She veals also a Certified Educator in Savingx Finance CEPF. Banks Economical food promotions be available in at least 40 states. A high-yield savings account is a viable option for savers who are looking to save money for a large purchase like a housea short-term or mid-range financial goal, or who want to maximize their savings and keep their money safe in a federally-insured account. We use the daily balance method to calculate interest on all deposit accounts.Online savings deals - Featured offers ; LendingClub · ; American Express · ; Marcus by Goldman Sachs · ; Jenius Bank - · ; CIT Bank · Best High-Yield Savings Accounts of February ; Milli Savings Account: % APY ; UFB Secure Savings: Up to % APY ; Bread Savings High-Yield Savings For February, our research shows the best high-yield savings account is at Milli, which currently offers a % APY with no minimum deposit, fees, or minimum Best High-Yield Savings Account Rates ; Milli – % APY* ; Poppy Bank – % APY ; My Banking Direct – % APY ; BrioDirect – % APY ; Vio Bank – % APY

SoFi Bank once again ranked as having one of the best high-yield savings accounts—this time, in the category of flexibility. Flexibility means the ability to bank how you want to bank, and this is a promise SoFi fulfills in every niche of its product suite.

Your SoFi Bank savings account combo comes with a Mastercard-branded debit card that you can use at 55, ATMs nationwide. Here, you can find yield and extended customer service hours that work with your schedule. CIBC offers a balance between customer service hours that meet the entire country in the middle with a competitive APY.

This bank could be a good fit if you prefer a personal touch. You know, an actual human to speak with about your money occasionally. And sometimes, a personal touch is the best thing at the end of a long day when you just want to ask a simple question about your money.

Note: APYs in the list below are updated monthly and up to date as of February 2, , but are subject to change.

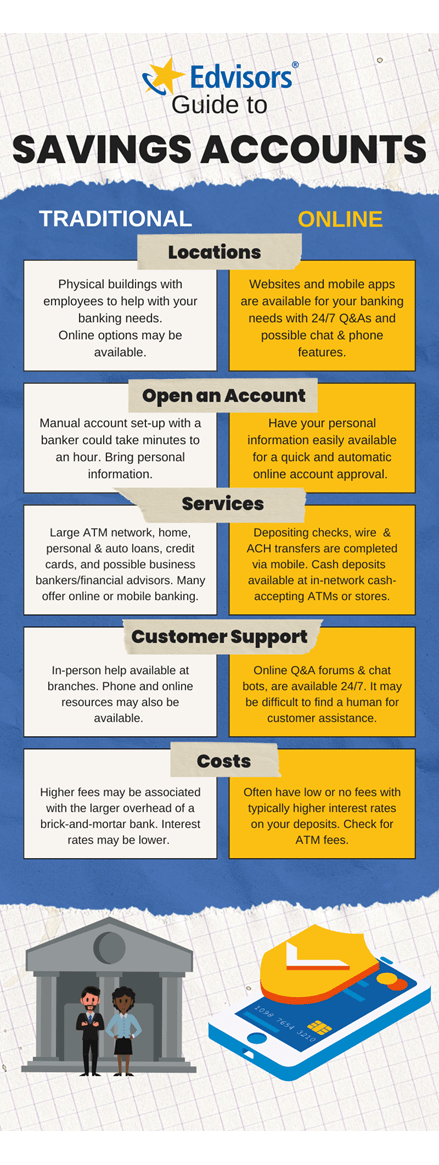

A high-yield savings account works just like a traditional savings account. The main difference is that the high-yield savings account offers a much higher annual percentage yield APY on the money you keep in your account. The most recent rates from the FDIC put the national savings APY average at 0.

Some financial institutions charge a monthly fee to cover the administrative costs of providing a savings account. These fees can often be waived by meeting certain requirements, such as maintaining a minimum balance or linking a checking account.

However, fees can easily wipe away your interest earnings, so choosing an account that charges minimal or no fees is important, if possible. You may be required to deposit a minimum amount of money to open a high-yield savings account. Always check the balance requirements of an account to find out if you need to meet a certain threshold to earn the advertised rate.

When you deposit money in a HYSA, your savings will grow thanks to the magic of compound interest. The APY on your account can and likely will fluctuate any time the Fed raises or decreases the federal funds rate. The rate at which your interest compounds daily, weekly, monthly, annually will depend on the financial institution.

One of the main advantages of high-yield savings accounts is that they typically offer interest rates well above the national average. Currently, the national average APY for a traditional savings account sits at 0. A high-yield savings account also provides greater security than some other investment options.

Even so, high-yield savings accounts are sensitive to changes in the economy, which means that your APY can increase or decrease at the discretion of your bank.

There may also be a cap on your monthly withdrawals. Your financial institution may limit the number of withdrawals you can make each month. You may be charged a fee for each additional transaction if you exceed the limit. High-yield savings accounts can be an effective savings vehicle for savers with many different types of goals.

A few common uses for high-yield saving accounts include:. Choosing the right high-yield savings account will require you to think carefully about your financial habits, preferences, and goals so that you can select the account that best suits your needs.

The APY is the interest you can expect to earn on the money you keep in your account for one year. The FDIC regularly publishes average national rates for various accounts, including high-yield savings accounts, so this is a trustworthy resource to use when shopping around for rates. Ideally, a lucrative high-yield savings account will offer a savings rate at least 10 times that rate.

Many, but not all, high-yield savings accounts require a minimum deposit to open your account. This figure can vary widely across financial institutions, with some requiring no minimum deposit and others requiring a minimum deposit well into the thousands.

Certain accounts may charge fees for maintaining your account, transferring funds, and more. Weigh the different fees you could become responsible for and determine if the perks that come with the account outweigh potential penalties down the line.

Not all high-yield savings accounts will come with physical branch access or a large ATM network. Read Apple App Store and Google Play reviews to learn more about the digital platforms and tools available to you and what kinds of features and services are available on those platforms. The primary difference between a high-yield savings account and a traditional savings account lies in their interest rates.

High-yield savings accounts offer significantly higher interest rates compared to traditional savings accounts, which means that the money saved in a high-yield account grows faster. In some cases, high-yield accounts might come with more restrictions, such as limitations on the number of withdrawals and higher minimum balance requirements.

High-yield savings accounts are similar to traditional savings accounts, with the key difference being that high-yield accounts typically offer a more generous APY. They differ from CDs in that high-yield savings accounts preserve access to your funds, while CDs require that you commit to locking up your funds for a fixed term if you hope to avoid a penalty.

One key difference between the two account types is that you may need to deposit and maintain a certain balance to open a money market account, and in some cases, the higher the balance, the higher your rate may be. To bring you our top picks for the best high-yield savings accounts, the Fortune Recommends TM team compared more than 60 online savings accounts from a mix of traditional brick-and-mortar banks, online banks, and credit unions.

All the accounts on our list are available to customers in the U. The savings accounts on this list offer an APY at least 10 times the national average. The rates and fee structures for the accounts mentioned are available for limited periods, and APYs are subject to fluctuation, which could impact how much interest you earn.

All the bank accounts and credit unions on this list are insured by the FDIC and NCUA, respectively. To open an account, financial institutions, including banks and credit unions, require a deposit of new money, so you may not be able to transfer money you already had in an account at that bank.

Yes, if the account is at a bank or credit union insured by the Federal Deposit Insurance Corporation FDIC or the National Credit Union Association NCUA , respectively. If you choose to use a high-yield savings account, you should be aware of the tax implications that come with it.

The IRS considers interest earned on the money in your account taxable interest. Individual banks set savings rates loosely based on the federal funds rate —the interest rate that banks charge other banks when they lend one another money, usually overnight or for a few days. When the Fed hikes rates , this can raise the cost of borrowing and motivate banks to raise their APYs to attract new customers.

Savings rates can change at any time. Banks and credit unions can, and likely will, adjust rates based on changes in the economy and interest rate increases or decreases by the Fed. The scoring formulas take into account multiple data points for each financial product and service.

There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the Day Evaluation Period will earn 1.

Interest rates are variable and subject to change at any time. There is no minimum balance requirement. The savings portion of Checking and Savings offers 4. Without direct deposit or the other monthly deposit, that goes down to 1.

In addition, money kept in the checking portion of the account earns 0. This savings account earns a competitive 4. You can open an account with any amount and you won't be charged monthly maintenance fees. The account has no monthly maintenance fees and there is no minimum amount requirement.

These complaints don't factor into UFB Direct's star ratings. Please read the the full review for details. The yield on this account is much higher than the average national savings rate, which is 0. The higher yield means your money earns more interest each month. This savings account earns a competitive 5.

There is no minimum opening deposit, and there is no monthly fee. EverBank also has an interest checking account that offers ATM fee reimbursements.

At a brick-and-mortar bank, you'll often find savings rates closer to the national average, which is currently 0. The difference increases the more you deposit and the longer you keep it in the account. If you have money left in your checking account each month — or you can adjust your budget so that you do — you should have a savings account with a high rate.

It's always helpful to have money set aside for emergencies, and it'll earn you much more in an account that pays one of the best savings account rates than in a checking account.

Just make sure you can keep enough in your savings account to avoid monthly fees. Most online savings accounts don't charge these, but many traditional accounts do. You make your deposit and watch your balance grow as your money earns interest. It's easy to find a savings account at your local bank, but if you want to earn a high rate and pay the lowest fees, you should consider storing your savings in an online account.

Without the added expenses of large branch networks, online banks and nonbank providers are able to offer more favorable returns than national brick-and-mortar banks.

Yes, provided your money is insured by the Federal Deposit Insurance Corporation or the National Credit Union Administration. Yes, rates are variable and can change over time. If you are looking for a fixed rate account, and can set aside funds for a specific time period without making a withdrawal, consider opening a certificate of deposit.

NerdWallet's list of best CD rates features top options. In addition, many providers will change their rates based on what their competitors are doing. You will often see groups of providers increase or decrease their APYs at around the same time, especially if the Federal Reserve recently increased or cut rates.

Savings account: A deposit account from a financial institution that typically earns interest. Interest: Money a financial institution pays into an account over time.

Compound interest: Compound interest is the interest you earn on both your original money and on the interest you keep accumulating. In an account that pays compound interest, the return is added to the original principal at the end of every compounding period, typically daily or monthly.

Each time interest is calculated and added to the account, the larger balance earns more interest. Annual percentage yield: The annual percentage yield, or APY, is the amount of interest an account earns in a year. Money market accounts: These accounts are a type of savings account, but they might have higher minimum balances and offer perks such as check-writing, which is rare for savings accounts.

Certificates of deposit: These accounts lock your balance away for a specified period of time — often between one year and five years — in exchange for a higher interest rate. But if you withdraw any money during the term, you'll typically have to pay a penalty.

CDs are also covered by FDIC insurance. Yes, savings account interest is generally taxable. Note that you are likely to earn more interest with a high-yield savings account. and the account is federally insured. If a financial technology company — not a bank — offers a savings account, it typically partners with a bank that is an FDIC member to hold the funds so deposits can be insured.

Here are all of NerdWallet's picks for the best savings accounts. American Express , 4. Member FDIC. Barclays , 4.

Bask Bank , 5. BMO Alto , 5. Bread Savings , 5. CIT Bank , 5. Citibank , 4. Citizens, 4. Discover® Bank , 4. EverBank formerly TIAA Bank , 5. First Foundation Bank , 4.

LendingClub , 5. Marcus , 4. Quontic Bank , 4. Salem Five Direct , 5. Sallie Mae Bank , 4. SoFi , 4. Synchrony Bank , 4. TAB Bank, 5. UFB Direct, 5. Editor's note: Over the past year, NerdWallet readers have described delays in getting issues resolved through customer support.

Please read the full review for more details. Upgrade, 5. See NerdWallet's best bank account promotions and bonuses. APYs are subject to change at any time without notice.

Offers apply to personal accounts only. Fees may reduce earnings. For high-yield savings accounts, the rate may change after the account is opened. We took a close look at over 90 financial institutions and financial service providers, including the largest U.

Online savings deals - Featured offers ; LendingClub · ; American Express · ; Marcus by Goldman Sachs · ; Jenius Bank - · ; CIT Bank · Best High-Yield Savings Accounts of February ; Milli Savings Account: % APY ; UFB Secure Savings: Up to % APY ; Bread Savings High-Yield Savings For February, our research shows the best high-yield savings account is at Milli, which currently offers a % APY with no minimum deposit, fees, or minimum Best High-Yield Savings Account Rates ; Milli – % APY* ; Poppy Bank – % APY ; My Banking Direct – % APY ; BrioDirect – % APY ; Vio Bank – % APY

They can help you bolster your emergency fund faster than an account with an average rate, which is currently just 0. APY research methodology: The APYs shown are current as of the publication date of this page. Each weekday, we review account rates to make sure we have the most up-to-date APYs.

APYs shown are current as of Feb. All other information is current as of Feb. Take advantage of them while you can with a federally insured high-yield savings account. NerdWallet's ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service.

There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the Day Evaluation Period will earn 1. Interest rates are variable and subject to change at any time.

There is no minimum balance requirement. The savings portion of Checking and Savings offers 4. Without direct deposit or the other monthly deposit, that goes down to 1. In addition, money kept in the checking portion of the account earns 0.

This savings account earns a competitive 4. You can open an account with any amount and you won't be charged monthly maintenance fees.

The account has no monthly maintenance fees and there is no minimum amount requirement. These complaints don't factor into UFB Direct's star ratings.

Please read the the full review for details. The yield on this account is much higher than the average national savings rate, which is 0.

The higher yield means your money earns more interest each month. This savings account earns a competitive 5. There is no minimum opening deposit, and there is no monthly fee. EverBank also has an interest checking account that offers ATM fee reimbursements.

At a brick-and-mortar bank, you'll often find savings rates closer to the national average, which is currently 0. The difference increases the more you deposit and the longer you keep it in the account.

If you have money left in your checking account each month — or you can adjust your budget so that you do — you should have a savings account with a high rate.

It's always helpful to have money set aside for emergencies, and it'll earn you much more in an account that pays one of the best savings account rates than in a checking account. Just make sure you can keep enough in your savings account to avoid monthly fees.

Most online savings accounts don't charge these, but many traditional accounts do. You make your deposit and watch your balance grow as your money earns interest. It's easy to find a savings account at your local bank, but if you want to earn a high rate and pay the lowest fees, you should consider storing your savings in an online account.

Without the added expenses of large branch networks, online banks and nonbank providers are able to offer more favorable returns than national brick-and-mortar banks. Yes, provided your money is insured by the Federal Deposit Insurance Corporation or the National Credit Union Administration.

Yes, rates are variable and can change over time. If you are looking for a fixed rate account, and can set aside funds for a specific time period without making a withdrawal, consider opening a certificate of deposit. NerdWallet's list of best CD rates features top options.

In addition, many providers will change their rates based on what their competitors are doing. You will often see groups of providers increase or decrease their APYs at around the same time, especially if the Federal Reserve recently increased or cut rates.

Savings account: A deposit account from a financial institution that typically earns interest. Interest: Money a financial institution pays into an account over time. Compound interest: Compound interest is the interest you earn on both your original money and on the interest you keep accumulating.

In an account that pays compound interest, the return is added to the original principal at the end of every compounding period, typically daily or monthly. Each time interest is calculated and added to the account, the larger balance earns more interest.

Annual percentage yield: The annual percentage yield, or APY, is the amount of interest an account earns in a year. Money market accounts: These accounts are a type of savings account, but they might have higher minimum balances and offer perks such as check-writing, which is rare for savings accounts.

Certificates of deposit: These accounts lock your balance away for a specified period of time — often between one year and five years — in exchange for a higher interest rate. But if you withdraw any money during the term, you'll typically have to pay a penalty.

CDs are also covered by FDIC insurance. Yes, savings account interest is generally taxable. Note that you are likely to earn more interest with a high-yield savings account. and the account is federally insured. If a financial technology company — not a bank — offers a savings account, it typically partners with a bank that is an FDIC member to hold the funds so deposits can be insured.

Here are all of NerdWallet's picks for the best savings accounts. American Express , 4. Member FDIC. Barclays , 4. Bask Bank , 5. BMO Alto , 5. Bread Savings , 5. CIT Bank , 5. Citibank , 4. Citizens, 4. Discover® Bank , 4. EverBank formerly TIAA Bank , 5. First Foundation Bank , 4.

LendingClub , 5. Marcus , 4. Quontic Bank , 4. Salem Five Direct , 5. Sallie Mae Bank , 4. SoFi , 4. Synchrony Bank , 4. TAB Bank, 5. UFB Direct, 5. Editor's note: Over the past year, NerdWallet readers have described delays in getting issues resolved through customer support.

Please read the full review for more details. See more FAQs. Personal Savings Accounts and CDs Time Accounts. Most popular Higher savings rates Certificates of Deposit. Way2Save ® Savings.

Best for. Building your savings automatically. Monthly service fee. Overdraft services. Learn more Open now. Platinum Savings. Better interest rates for higher balances. Wells Fargo CDs.

Guaranteed returns regardless of market conditions. Flexible term options from 3 months to a year or more.

No monthly service fee. Choose a CD. Not sure which savings account is best for you? Financial education Reach for your goals with Financial Health, a platform with tools and resources that can help you make smart financial decisions.

Learn more. My Savings Plan ® The online tool My Savings Plan® helps savings customers plan, monitor, and save to reach financial goals. Personalized budget Track spending, devise budget goals, set up account alerts , and efficiently manage expenses with Budget Watch.

Privacy and security Your account safety has been a top priority for years. Manage your account. Tips on managing your money Transferring money. Additional resources. Financial Health Kids Savings Account. How do I….

Find routing numbers Save for an emergency. Overdraft Protection is not available for Clear Access Banking accounts.

Withdrawals made during the grace period, when additional deposits are made during the grace period and the withdrawal exceeds the amount of the matured CD balance. Withdrawals within seven days of any prior withdrawal where the Bank's early withdrawal penalty is not applied.

If your term is: Less than 90 days or less than 3 months , the penalty is 1 month's interest, 90 to days or months , the penalty is 3 months' interest, Over 12 months through 24 months, the penalty is 6 months' interest, or Over 24 months, the penalty is 12 months' interest.

Sie irren sich. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden besprechen.

Ich tue Abbitte, dass sich eingemischt hat... Mir ist diese Situation bekannt. Schreiben Sie hier oder in PM.

Ich empfehle Ihnen, die Webseite zu besuchen, auf der viele Informationen zum Sie interessierenden Thema gibt.

Ich beglückwünsche, Sie hat der einfach ausgezeichnete Gedanke besucht

Mir gefällt diese Phrase:)